Guest Opinion by Jann Mirchandani

Note: the following guest article was printed in the Yorktown News, May 20, 2025

Tax Exemptions and Their Impact

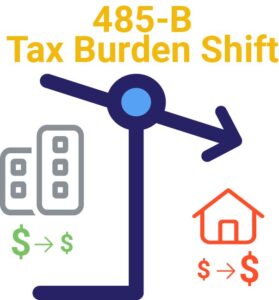

As I outlined in my January Letter to the Editor, Yorktown’s current Business Improvement Exemption Law (485-b) grants overly broad tax breaks to commercial developers without guiding growth toward community benefits. Since then, the Town Board’s own report showed that developers have “saved” $352,304 in town taxes from just nine projects, savings that ultimately fall on residents to make up. When school taxes are included, taxpayers are covering more than $1.5 million in lost revenue from these projects alone.

Unlike neighboring communities that evaluate proposals case-by-case, Yorktown’s automatic tax breaks ignore that market forces—not tax incentives—primarily drive development decisions. Major retailers choose locations based on traffic patterns, population density, and transportation access.

A Fragmented Approach to Growth

Yorktown’s development challenges extend beyond tax policy. We implement tools like tax incentives and overlay districts inconsistently and without a unified vision. These should work together as part of a comprehensive strategy. Instead, we grant financial incentives automatically while making overlay district decisions reactively, creating an incoherent development landscape.

Overlay districts, which add regulations or incentives on top of existing zoning, should guide development toward community goals. Instead, Yorktown implements them on a case-by-case basis. Projects like the boutique hotel and Underhill Farms were added after the districts were established, with Navajo Fields potentially joining that list. This reactive approach enables projects that increase sprawl rather than containing it.

Both our tax exemption policy and overlay district implementation represent missed opportunities to strategically guide development that strengthens our community and protects our tax base.

Environmental Impacts

Our current approach also carries significant environmental consequences. The Regional Plan Association’s April 2025 report notes that “households in suburban Westchester produce twice the greenhouse gas emissions of New York City because sprawling land use patterns require residents to drive.” The report points out that Westchester has lost around 14,300 acres of forest land since 2001, with 90% lost to sprawl.

The inconsistency in our development approach is perfectly illustrated in the current discussions about removing sidewalks from the Underhill Farms project. Though not yet approved, eliminating pedestrian infrastructure undermines the very purpose of the overlay district, which was to create walkable spaces. Removing sidewalks would force residents into cars for even short trips, increasing emissions and congestion.

Preserving Yorktown’s Character

These challenges threaten what makes Yorktown special—our green spaces, woodlands, and residential neighborhoods that draw families here. Smart development can respect both fiscal needs and community values by concentrating mixed-use projects near existing infrastructure.

A Path Forward

Yorktown needs a clear plan connecting tax breaks and zoning rules. We should review exemption requests based on community benefit instead of granting them automatically and develop an overall plan for overlay districts instead of adding projects one by one. We must look beyond short-term tax gains to consider long-term infrastructure costs while encouraging development that strengthens our tax base without burdening homeowners.

The real choice isn’t between development and preservation—it’s between our current patchwork approach and thoughtful growth that strengthens Yorktown while protecting what makes our town special.